BillEase Merchant/CS FAQs | EasyPace

BillEase Merchant/CS FAQs | EasyPace

What is EasyPace?

EasyPace offers an enhanced experience, enabling customers to pay less interest fees each time they make their regular monthly installments, especially when they pay early. It’s a smarter and more flexible way to manage their payments and reduce their overall costs.

How does EasyPace work?

Each regular monthly installment consists of both the principal amount and the interest fee. As you pay down your loan, a larger portion of each payment goes toward the principal, and less toward interest. When an overpayment is made, the excess amount is applied to reduce the principal balance. This results in a recalculation of the interest fee based on the lower principal, helping customers reduce their interest fees over time.

Customer Journey:

- Customer scans the merchant’s QR code or proceeds to the merchant’s web checkout.

- Customer inputs the amount and item.

- If the amount is equal to or higher than 5,000 pesos, EasyPace will appear as a payment plan. If the amount is lower than 5,000 pesos, the merchant's default payment plans will only be shown (Most Flexible / Pay with Grace - depending on the partnership agreements with merchants).

- Customer chooses EasyPace as a payment plan.

- Customer selects their preferred installment terms.

- If amount is between 5,000-9,999 pesos, configurable installment terms are from 6 to 12 months.

- If amount is 10,000 pesos and above, configurable installment terms are from 12 to 24 months.

- Customer selects their preferred repayment frequency.

- Customer reviews the loan agreement (PNDS).

- Once agreed, tick the checkbox ✅ and click Confirm to complete transaction.

How much is the processing fee for EasyPace?

The processing fee for EasyPace is 10% and is indicated in their loan agreement.

Are there hidden charges?

None, there are no hidden charges. All fees and charges are outlined and disclosed in their loan agreement (PNDS) before loan approval.

How can customers make an overpayment?

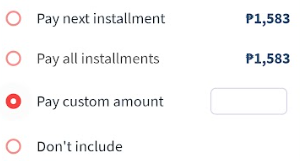

After selecting the installment plan you’re intending to pay, make sure to choose “Pay custom amount” and input the amount you want to pay. Please note that it should be higher than the amount shown in “Pay next installment”.

Will overpayments be applied as an advance or partial payment to the next monthly due?

No, overpayments will be applied to reduce the principal amount. Future monthly dues will be recalculated based on the remaining principal balance, and customers will then follow the updated monthly dues.

How can I track my loan or principal balance?

After successful repayment and after the due date, BillEase will send you an updated Amortization Schedule, as explained in the Promissory Note and Disclosure Statement. You will receive this schedule via email, and it will also be accessible in the app, allowing you to track your loan progress conveniently.

Can I make advance payments?

Yes, you can make advance payments for your monthly installments. Any payment made before the due date will be applied to the next scheduled installment first, with any excess amount allocated to the principal. Once a payment is received, the amortization schedule will be adjusted accordingly.

Do I still need to pay the next monthly installment if I have already made an advance payment?

No, if you make an advance payment, you will not need to pay for the next monthly installment. For example, if your next due date is on February 1 and you make an advance payment on January 25, your advance payment will cover the February installment, and you will not be required to make a payment on February 1. The advance payment will be applied to the upcoming due date, effectively postponing the need for you to pay until the following month.

What happens if I miss a payment?

If you miss a payment, it will not forfeit the product plan but late payment penalties may apply, and your credit score could be affected. It is important to contact customer service immediately to discuss available options and avoid additional charges or negative impacts on your credit profile.

Who is eligible for EasyPace?

Customers must be an active BillEase user with good repayment history and meet the necessary credit assessment criteria. Eligibility may also depend on the amount the customer is purchasing if it reached the minimum requirement for EasyPace.

Why is EasyPace not reflected in my BillEase app as a payment plan?

If EasyPace is not reflected in your account as a payment plan upon checkout, make sure to double check if the version of the app that you are using is updated. Simply go to PlayStore or App Store to check if there are available updates for BillEase. Once updated, relogin to your account and redo the transaction.